11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Students should carefully note that every adjustment has at least two effects due to double entry. Recall the transactions for Printing Plus discussed inAnalyzing and Recording Transactions. Adjusting entries affect at least one nominal account and one real account. The entry for bad debt expense can also be classified as an estimate. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- In the accounting cycle, adjusting entries are made prior to preparing a trial balance and generating financial statements.

- The following entries show theinitial payment for the policy and the subsequent adjusting entryfor one month of insurance usage.

- The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received).

- Sometimes, your bookkeeper can enter a recurring transaction, and these entries will be posted automatically each month before the close of the period.

Understanding Adjustment Entries

In all the examples in this article, we shall assume that the adjusting entries are made at the end of each month. In this article, we shall first discuss the purpose of adjusting entries and then explain the method of their preparation with the help of some examples. In the next lessons, we will illustrate how to prepare adjusting entries for each type and provide examples as we go. Did we continue to follow the rules of adjusting entries inthese two examples? In this case, Unearned Fee Revenue increases (credit) and Cashincreases (debit) for $48,000.

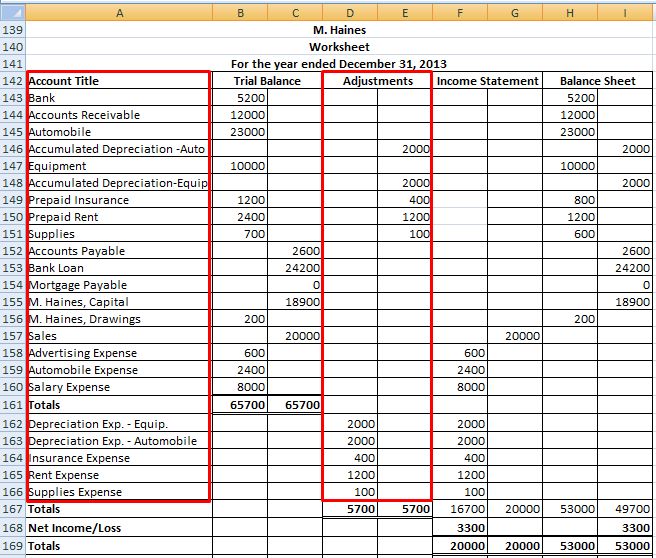

Depreciation expenses

Two main types of deferrals are prepaid expenses andunearned revenues. Adjusting entries, also called adjusting journal entries, are journal entries made at the end of a period to correct accounts before the financial statements are prepared. Adjusting entries are most commonly used in accordance with the matching principle to match revenue and expenses in the period in which they occur. The purpose of adjusting entries is to assign an appropriate portion of revenue and expenses to the appropriate accounting period. By making adjusting entries, a portion of revenue is assigned to the accounting period in which it is earned, and a portion of expenses is assigned to the accounting period in which it is incurred.

What Is an Adjusting Journal Entry?

If you don’t make adjusting entries, your books will show you paying for expenses before they’re actually incurred, or collecting unearned revenue before you can actually use the money. One of the main financial statements (along with the balance sheet, the statement of cash flows, and the statement of stockholders’ equity). The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations.

What Does an Adjusting Journal Entry Record?

Want to learn more about recording transactions as debit and credit entries for your small business accounting? These prepayments are first recorded as assets, and as time passes by, they are expensed through adjusting entries. If you create how to develop an aggregate plan for your operations management financial statements without taking adjusting entries into consideration, the financial health of your business will be completely distorted. Net income and the owner’s equity will be overstated, while expenses and liabilities understated.

Adjustments reflected in the journals are carried over to the account ledgers and accounting worksheet in the next accounting cycle. Let’s pause here for a moment for an explanation of what happened “behind the scenes” when you made your insurance payment on Dec. 17. When you entered the check into your accounting software, you debited Insurance Expense and credited your checking account. However, that debit — or increase to — your Insurance Expense account overstated the actual amount of your insurance premium on an accrual basis by $1,200. So, we make the adjusting entry to reduce your insurance expense by $1,200.

Accounting software can be used to simplify the process of recording adjustment entries. Most accounting software has built-in features that allow for the easy creation and recording of adjustment entries. The adjustment entry is then recorded in the general ledger using the appropriate accounts and amounts. The bookkeeper or accountant must ensure that the adjustment is recorded correctly as a debit or credit to the appropriate account, depending on the nature of the adjustment. The matching principle is a fundamental accounting principle that requires expenses to be matched with the revenues they generated.

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. — Paul’s employee works half a pay period, so Paul accrues $500 of wages. Adjusting entries will play different roles in your life depending on which type of bookkeeping system you have in place. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. The magic happens when our intuitive software and real, human support come together. Book a demo today to see what running your business is like with Bench.

An adjusting entry is needed so that December’s interest expense is included on December’s income statement and the interest due as of December 31 is included on the December 31 balance sheet. The adjusting entry will debit Interest Expense and credit Interest Payable for the amount of interest from December 1 to December 31. Adjusting journal entries can get complicated, so you shouldn’t book them yourself unless you’re an accounting expert. Your accountant, however, can set these adjusting journal entries to automatically record on a periodic basis in your accounting software.

Adjusting entries are accounting journal entries that convert a company’s accounting records to the accrual basis of accounting. An adjusting journal entry is typically made just prior to issuing a company’s financial statements. Income statement accounts that may need to be adjusted include interest expense, insurance expense, depreciation expense, and revenue.

Others leave assets on thebooks instead of expensing them when they should to decrease totalexpenses and increase profit. The purpose of adjustment entries is to bring the accounts up to date and to ensure that the financial statements accurately reflect the company’s financial position and performance. Entries are made with the matching principle to match revenue and expenses in the period in which they occur.